The 2018 edition of Capgemini’s World Wealth Report, released earlier today, stated that global high-net-worth individual (HNWI) wealth has for the first time surpassed US$70 trillion, following a 10.6% increase in wealth over the previous year, and marking the sixth-consecutive year of growth. The report also recorded a 1.6 million increase in HNWI population. This positive growth pattern is expected to continue and will ultimately lead to global HNWI wealth exceeding US$100 trillion by 2025.

Persistent surge in HNWI population and wealth

The increase in HNWI population and wealth in 2017 has been primarily instigated by the Asia-Pacific and North America, with a combined contribution of 74.9% and 68.8% to the rise in HNWI population and wealth respectively. Asia-Pacific had the most significant effect, attributing a considerable 42.4% to the global HNWI population growth and 41.4% to the increase in global HNWI wealth. Ultra-HNWIs saw an 11.2% global population increase and 12% wealth expansion.

India was the fastest growing market both in the Asia-Pacific and globally, following an expansion of 20.4% in Indian HNWI population and 21.6% in local HNWI growth, largely bolstered by the solid equity market.

The largest concentration of HNWIs for 2017 was in the US, Japan, Germany, and China, which together account for 61.2% of the HNWI population. Some other markets which saw notable advancements in HNWI population figures include India, Kuwait and Sweden.

Vigorous return on investments

According to Capgemini, for 2017, HNWIs enjoyed a robust 27.4% in global investment returns.

Concerning asset allocation, the top three global asset classes were Equities (30.9%), Cash and Cash Equivalents (27.2%), and Real Estate (16.8%). Asset trends remained more or less steady in Q1 2018 over Q2 2017. Notably , real-estate moved up to the third-largest asset class, prompted by residential holdings, and was in fact the only asset class that saw an increase in investment.

Cryptocurrency fervour

The new spotlight on digital currency was also verified in the Capgemini report, with 29% of HNWIs in 2017 being highly interested in the venture of holding cryptocurrencies, and 26.9% being somewhat interested. Investments in cryptocurrency reached an all-time high in January 2018 with market capitalization nearing US$850 billion. Investment objectives range amongst HNWIs, however store of value and investment returns stand as the most popular. Considering that the virtual currency market is still gearing up in its inception stage, HNWIs remain wary and management firms hesitant with concerns in price volatility and market security. 71% of young HNWIs, however, place high value on receiving cryptocurrency information from their primary wealth management firms. Therefore, while wealth management have remained cautious due to unclear regulations, they are likely to be pushed to a decision, particularly by these younger HNWIs.

Continued popularity and challenges for wealth management firms

The utilization of wealth management firms still remains widespread amongst HNWIs, however asset consolidation around the primary wealth management provider has continued to increase. Capgemini predicted that eightened personal connections between management firms and their HNW clients would to boost HNWI satisfaction scores.

The HNWI demand for hybrid advice has also persisted, and wealth-management firms, faced with the anticipated competition of BigTech firms in the industry have been pressured to hasten budgetary and hybrid-advice transformation. Indeed, 37.5% of HNWIs would be interested in diverting 11%-50% of their wealth to BigTech firms for wealth management purposes. Nevertheless, the positive investment returns were not proportionate to satisfaction increases, indicating that budgets and hybrid-advice are not evolving at a fast-enough rate.

With an increasing number of High Net Worth Individuals (HNWI) choosing to leave the Middle East due to the high level of instability, many are opting to invest in Europe which is a more secure alternative, increasing the demand for second citizenship.

Political Instability in the Middle East

When analysing the region, it is impossible not to begin with one of the most prominent factors contributing to its uncertainty; the decade long dispute between Saudi Arabia (Sunni) and Iran (Shia). Although they have not technically declared war on each other, they have been on opposite sides of countless proxy wars. This rivalry comes from the religious split between both countries, seen as the ultimate authorities for Sunni and Shia Islam.

This has led to a number of different intrastate conflicts which have contributed to the creation of failed states, most notably in Iraq, Syria and Yemen. This has further contributed to the destabilisation of the Middle East. Tensions have also risen between Qatar and Saudi Arabia, which have had detrimental effects to the former’s economy, a prime example of which is the national airline, Qatar airways, creating what has become to be known as the Qatar Crises.

Keeping in mind the political and religious conflicts throughout the region, it is no surprise that power vacuums left in their wake have been filled up by extremist terrorist organisations, from the rise of ISIS (Daesh) in Syria and Iraq, to Hezbollah in Lebanon, the Muslim Brotherhood in Egypt and the international Al-Qaeda, amongst others. However, this has exacerbated beyond political problems, with the economy also being affected, furthering pressure to look beyond the region and invest in Europe. A key example being the 2011 Arab spring which according to the UN, the Middle East lost some US$600bn in economic growth.

Religious divide in the Middle East

Along with the political instability, religious conflict has also continued to fuel the fire and destabilise the region, and consequently divert high-net-worth individual’s focus to instead invest in Europe. Primarily, the Sunni/Shia divide, a split between two different denominations of Islam. This was brought to the forefront after Iran’s Islamic Revolution in 1979 which gave Shia cleric Ayatollah Ruhollah Khomeini the opportunity to implement his vision for an Islamic Shia government. The eventual emergence of Iran as a leader in the region competed with the dominance of Saudi Arabia and its Sunni clerics, dividing the middle east further.

The divide is also present between different religions, most prominently in the decades long rift between the Muslim Arabic countries and Israel, a Jewish state. This is further substantiated by the USA’s support of Israel and its opposition towards Iran and its nuclear ambitions. This has resulted in sanctions against Iran, creating another issue in the region. Another split is present between the Muslims and Christians in states like Lebanon, however this is uncharacteristically less divisive.

Economic instabilities in the Middle East

The economies of middle eastern countries are very similar in the fact that they are highly dependent on oil, which makes them vulnerable to economic hardships due to many of them having undiversified economies. Relatively stable states in the region are also grappling with low oil prices alongside chronic youth unemployment.

Prolonged low oil prices are forcing governments to take austerity measures mostly through spending cuts, concentrated on capital expenditure. Spending cuts have also lowered growth in non-oil sector

Because of these three overlapping factors, HNWI in these countries chose to move to more stable countries, predominantly in the EU and USA. This has also motivated individuals in the Middle East to invest in Europe and consider economic citizenship as a procursive tool to secure the safety of both their families and their wealth.

Middle East HNWI invest in Europe through citizenship by investment

In 2016, 63% of HNWI surveyed reported that they are likely to invest their money in overseas real-estate, making it more evident that HNWI want to diversify their portfolios, many opting to invest in Europe. When investing in Europe, hotels and property tend to be favourites among Middle East HNWI.

Investment in Europe can also be achieved through citizenship by investment programmes. Malta and Cyprus are two European states which offer second citizenship by investment programmes through different investment paths including property.

Visa Free Travel is another benefit of having a European passport as they have a high number of visa free travel destinations. For instance, Malta offers visa free travel to 167 different countries including the EU Schengen Area and the US. Other factors which draw investment towards the EU include; a high quality of life, economic stability, security and better healthcare and education.

Many high net worth individuals have chosen Malta and Cyprus as their second home, following the launch of the Malta and Cyprus Citizenship by Investment programmes. The Cyprus Citizenship by Investment programme was launched in 2013, just one year earlier than Malta Citizenship by investment programme, or the Individual Investor Programme. One of the programmes’ requirement in both countries is an investment in real estate.

Investing in real estate

To acquire Maltese citizenship, a candidate must purchase a property worth at least €350,000 and keep the property for at least five years. Alternatively, an applicant can lease a property for five years, with a minimum lease value of €16,000 a year. Under the Cyprus Citizenship by Investment programme, the candidate has two different options to obtain citizenship – a combination of real estate and/or other investments with a minimum value of €2.5 million; or a €2 million (plus VAT) investment in residential real estate. Regardless of the route chosen, a residential real estate of a minimum value of €500,000 must be held indefinitely, while the rest investment can be recovered after 3 years.

Impact of Citizenship by Investment programmes on real estate

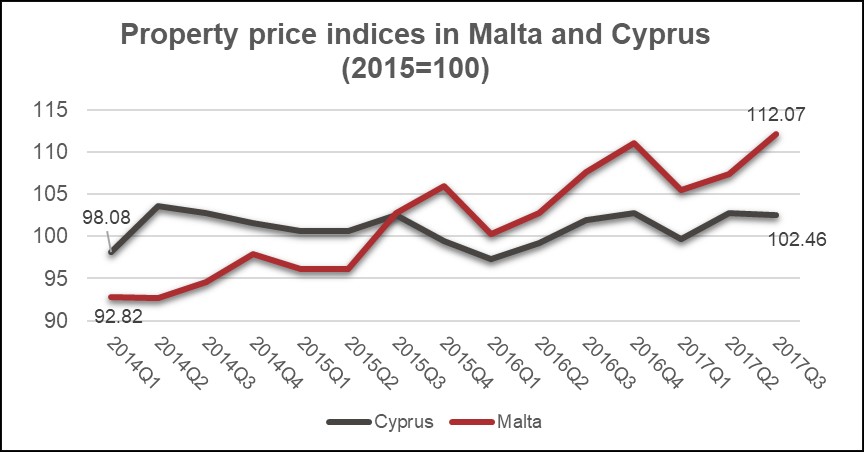

According to the Central Bank of Malta, the Malta Citizenship by Investment programme is one of the major contributors to the positive trend in the property market. Malta’s real estate and construction industry has witnessed significant growth in the past four years, contributing on average 9% to the country’s Gross Value Added (GVA), according to the National Statistics Office. Between Q1 2014 and Q3 2017, there was an increase of over 19% in Malta’s property prices (Figure 1). The Cypriot real estate market also experienced an increase in prices albeit at a much lower rate of 4% over the same period.

Source: Eurostat, CCA analysis

One of the main reasons fuelling property prices in Malta, is the impact that the Malta Citizenship by Investment had on the rental market, given the possibility of renting a property instead of buying it. In fact, the latest report from the Office of the Regulator of the Individual Investor Programme, revealed that since the programme’s inception till 30 June 2017 over 85% of applicants chose the leasing option.

The rise in property prices can also be attributed to other factors, such as a significant economic growth, increase in foreign workers which contributed to the increased demand for rental property, and increased demand for office space. According to the Central Bank of Malta, rental prices for a 1-bedroom flat in high demand areas (Sliema, St. Julian’s, Gzira and Valletta) increased over 40% between 2012 and 2015, while the increase in rents of detached houses in the same region amounts to almost 80%. For other regions, the rental prices of flats and detached houses also increased significantly by more than 30% over the same period.

The positive trend in the rental market, has also triggered a rise in the prices for acquisition of property, creating a favourable environment for property investment. In this regard Malta’s rental yield reached 6.64% in 2017, according to the Buy-To-Let table of the new WorldFirst’s research. Malta was ranked the 2nd most attractive country in Europe for buy-to-rent investment in 2017, which took a steep boost from the 8th place in 2016. Being ranked 9th in the table, Cyprus has a rental yield of 5.7%. Despite a more moderate rental yield, the real estate market in Cyprus remains a very attractive preposition for investment, especially due to increased demand as a result of the Cyprus Citizenship by Investment programme as well as a result of the stability of the market.

Malta has experienced an increase in foreign investment, since it launched the Citizenship by Investment programme, according to the programme Regulator (ORiip). The Fourth Annual report on the Maltese Individual Investor Programme (IIP), also known as Malta Citizenship by Investment programme, was issued on the 20th of December 2017. The report provides statistics, including the number of applications received, rejected and those naturalised, for the 12-month period between July 2016 and June 2017. It also offers a comprehensive breakdown by primary citizenship, spouses, dependents and investment options.

Citizenship by Investment applications received

According to the report, 377 applications were submitted during the reporting period, which is around 17% less compare to the 451 applications received during the previous period. This brings the total amount of applications since the programme’s inception up to 1101. Males as main applicants contributed the majority – 79% – of applications received. As regards the employment status, 56.7% of applicants were self-employed, 37.8% declared employed status, and 5.5% were non-economically active.

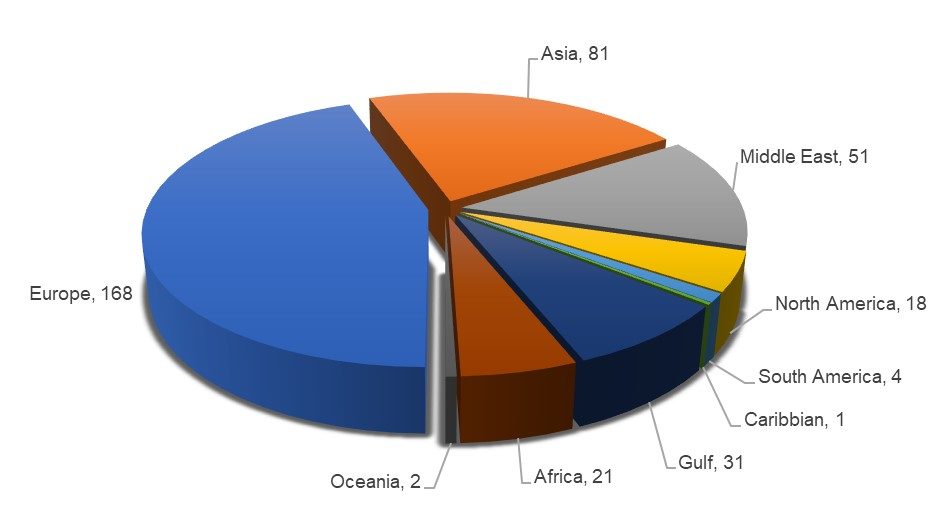

The statistics outline 9 main regions of origin for the applicants (Figure 1), that are Europe (168 applications), the Gulf Region (31 applications), Asia (81 applications), Africa (21 applications), the Middle East (51 applications), North America (18 applications), South America (4 applications), Caribbean (1 application), and Oceania (2 applications). Similar to the previous year, most of the applications came from the European region (mainly Russia and CIS). The number of applications from Asia and the Middle east increased compare to the previous reporting period, while those from the Gulf and Africa decreased. On average, each applicant contributed three dependents in the application, which made 962 dependants in total.

Figure 1. Total IIP applications by Region. Source: ORiip

Outcome of Applications

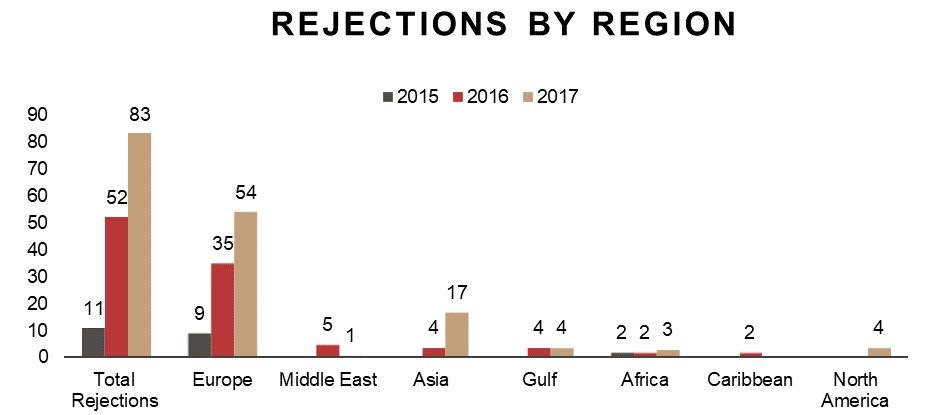

The amount of applications approved, which entails that the due diligence has been positively concluded and a letter of approval in principle has been issued, amounted to 422. This constitutes a significant increase from the previous year, 241, and also from the year before that, 75. This highlights the increased efficiency of the application process. There was also a significant number of applications (83) that were rejected during the year in question (Figure 2). Most of the rejected applications were submitted by applicants from Europe (54) and Asia (17). 386 applications have also reached the naturalisation stage, which is a significant increase from the amount recorded during the previous period, which stood at 137. Overall, the total number of naturalised citizens till the end of June 2017 is 566. Considering the cap of Malta Citizenship by Investment programme of 1,800 naturalisations (excluding dependents), more than 30% of the spots have been filled so far.

Figure 2. Total applications rejected by region. Source: ORiip

Investments and Contributions of the Citizenship by Investment programme

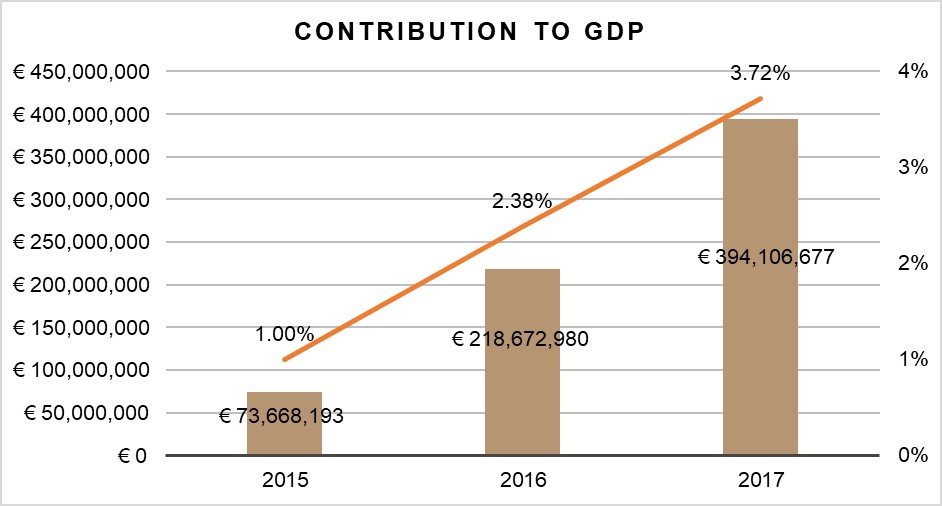

During the reporting period, the financial contributions amounted to €194 million to the National Development and Social Fund; €83 million to the Consolidated Fund; and €30 million to the Identity Malta Agency and the concessionaire. The amount invested in Government stocks between July 2016 and June 2017 totalled €58,371,279.83. Overall, during the reporting period the IIP contributed €394,106,676.68, which is equivalent to 3.72% of the GDP estimated to the same period.

Figure 3. The contribution of the Citizenship by Investment to the GDP. Source: ORiip

In terms of the Real Estate investments from purchased and leased properties, which is mandated by the programme, the contribution amounted to €35,284,168.97 and €33,659,279.80 respectively (considering the 5-years lease contract). The vast majority of applicants – 88% (340) – chose leasing, whereas the remaining 12% (46) purchased a property. Sliema, St. Julians, and Swieqi areas remain the most preferred property locations among the applicants since the programme’s inception. The amount spent by an applicant on a purchased property averaged at around €868,173.58, and the annual average rental value for leased property stood at €21,128.53. Both figures significantly exceed the Malta Citizenship by Investment programme requirements, which is €350,000 for purchasing and 16.000 per annum for leasing a property.

Dual citizenship arises when a person holds two or more citizenships simultaneously.

Is Irish Dual Citizenship allowed?

Irish Dual Citizenship is allowed under Article 24 of the Irish Nationality and Citizenship Act of 1956 which specifically allows individuals holding Irish Citizenship to obtain another form of citizenship. This will not automatically result in the renouncing of the individual’s Irish citizenship, unless such person expressly holds that he would no longer like to hold Irish citizenship.

The same act also stipulates the different ways in which foreign persons may acquire Irish citizenship as their second citizenship. In both cases, one must also take into consideration whether the other country involved, besides Ireland, allows dual citizenship or not.

The Irish passport has been ranked the 3rd most powerful passport for 2018, allowing individuals to travel to 172 countries without need of a visa. Being a Member State within the EU, this passport also allows citizens to enjoy the four freedoms guaranteed by the EU, involving freedom of movement of goods, capital, services and labour.

Acquiring Irish Dual Citizenship- for Irish Citizens

As previously stated, Irish law allows individuals holding Irish citizenship to obtain a second citizenship, or multiple citizenships. Such persons will not be forced to renounce their citizenship, unless the law of the other state involved calls for it. Irish dual citizenship may be acquired in several different manners, including:

- Birth – If an individual was born to at least one Irish parent within a foreign country’s territory, the principle of jus soli (law of the soil), will allow such person to acquire a foreign citizenship within the foreign country. The laws applicable in the foreign country must be taken into consideration.

- Descent – Individuals may inherit their citizenship from their parents or other ancestors through the principle of jus sanguinis, the right of blood. Therefore, if the person’s parent/s are immigrants in Ireland, he would be able to acquire his parent/s’ foreign citizenship as his second citizenship. Different approaches to this principle are taken according to the laws of the state in question.

- Adoption – A minor who holds Irish Citizenship may subsequently obtain dual citizenship if his adoptive parents are foreign citizens.

- Marriage – Individuals who marry citizens of a different country are able to acquire Irish Dual Citizenship, subject nonetheless to the country’s conditions.

- Naturalisation – A citizen of Ireland may also acquire dual citizenship within a foreign state after spending a particular amount of time within such country. Certain other conditions may be required upon acquiring such dual citizenship, however, these are dependent on the laws of the State.

- Citizenship by Investment Programmes – Recently there has been an upsurge in citizenship by investment programmes being offered to foreign individuals to acquire citizenship within a relatively short period of time, in return for a substantial investment within the country. The programmes available and their benefits will be listed further below.

Acquiring Irish Dual Citizenship – For Foreign Citizens

Foreign citizens who wish to acquire Irish citizenship in addition to their existing citizenship may be able to do so in three main ways:

- Birth/Descent

- Naturalisation

- Marriage

To acquire citizenship through one of the aforementioned means, the relevant criteria must be duly satisfied by the applicant.

Birth or Descent

Citizenship may be acquired through Birth or Descent if one of the following situations apply to the applicant:

- Born in Ireland: Individuals born in Ireland before 1st January 2005 will be entitled to acquire Irish Citizenship.

- Irish Citizen Parents: Individuals born after 1st January 2005 with parents who are Irish Citizens will be able to acquire Irish dual Citizenship.

- Foreign National parents: Even though the parents of the applicant are not from Ireland, the applicant may nonetheless be entitled to acquire Irish dual Citizenship if one of the following circumstances apply:

- The applicant is a child born on or after 1st January 2005, with parents from Britain or from Northern Ireland or the Irish State. This citizenship will not pose any restriction on the applicant’s residency.

- The applicant is a child of a parent who was granted refugee status.

- The applicant was born of any other foreign national parents on or after 1st January 2005, where a genuine link to Ireland must be proven by having 3 out of 4 years of reckonable residence in Ireland immediately before the birth of the child in question.

- Parents are Irish Citizens by Birth – Irrespective of the place of birth of the applicant, he will be able to benefit from automatic Irish dual Citizenship.

- Parents are Irish Citizens born outside of Ireland– The parents of the applicant are Irish Citizens but were born outside of Ireland. The applicant is still entitled to become an Irish citizen. If the applicant relies on his parent/s for Irish citizenship, and such parent has deceased, the authority must be satisfied that if such parent were alive at the time, he would still be an Irish Citizen, and therefore the applicant would be able to acquire Irish citizenship.

- Descent from Irish Grandparents: If the applicant’s grandparents are citizens of Ireland, but neither of the parents of the applicant are Irish, Irish dual Citizenship may still be granted.

Irish Citizenship law strictly stipulates that for citizenship to be acquired through ancestors, these must strictly be parents or grandparents. Citizenship may not be claimed on the basis of cousins, uncles, aunts, or other extended family members.

- Adoption: If the applicant is an adopted child, he may acquire Irish citizenship in the following situations:

- The child is not an Irish citizen, but his adoptive parent/s are Irish citizens.

- The parent/s of the child are Irish citizens living abroad. The adoption must be entered within the Register of Intercountry Adoptions.

Whenever a child is adopted from outside the state, upon applying for citizenship, the immigration procedures in place in Ireland must be duly observed.

- Deserted Infants: Unless proven to the contrary, a deserted infant who is found within Ireland will be considered to have been born in Ireland.

Naturalisation

Citizenship may also be acquired through the Naturalisation process, where the following conditions must be satisfied:

- The applicant is 18 years or older (if under the age of 18, the applicant must be married), or is a minor born in the State as from 1st January 2005;

- Applicant must be of good character, where investigations will be carried out regarding any criminal record or ongoing proceedings the applicant is involved in;

- The applicant must spend a period of 365 days of continuous reckonable residence within the state immediately before the date of application for naturalisation, and within the 8 years preceding this, the total reckonable residence must amount to 1460 days (4 years). In total, reckonable residence must add up to 5 years out of the last 9 years.

- The applicant must intend, in good faith, to reside in the state after the naturalisation procedure;

- A declaration of loyalty and fidelity to the state must be made, ensuring observance with the law and respect to the values upheld by the state.

Marriage

Citizenship through marriage may also be an option for foreign nationals whose spouse or civil partner has Irish citizenship. The procedure is very similar to that of naturalisation, however the conditions in the case of spouses or civil partners are more favourable. The following conditions must therefore be met for such a person to qualify:

- The person must be married or in a recognised civil partnership with an Irish citizen for a minimum of 3 years;

- A period of 1 year’s continuous reckonable residence in Ireland is required immediately before the date of the application. In the 4 years prior to this step, a total reckonable residence of 3 years out of the total 5 years are required.

- The marriage or civil partnership must be recognised and valid under Irish law;

- The spouses or civil partners must be living together as a married couple or civil partners;

- The applicant must be of 18 years or older, be deemed to have good character and express his intention to continue living in Ireland;

- A declaration of loyalty and fidelity towards the State must be made.

Reckonable Residence

As can be noted, in cases of naturalisation or acquisition of citizenship through marriage, the periods of residence are taken into consideration. Certain periods are expressly excluded upon calculation of the period of residence within the State, including presence within the state for study purposes or when a claim for asylum is still being considered.

If the applicant is an EEA national, no residency permit or documentation under the European Communities (Free Movement of Persons) Regulations of 2015 are required when spending time in Ireland. However, in the case of non-EEA citizens, unless they have express permission by the State to remain in the state, the period of time spent within Ireland will not be calculated for the purposes of reckonable residence.

Alternatives to Irish Dual Citizenship

Ireland’s Immigrant Investor Programme (IIP)

The relatively recent programme will allow HNW Individuals from outside the EU and EEA to invest a significant amount of money in Ireland, and simultaneously acquire 5 years of residence within the State. With each application, the competent authority must determine if the investment at hand will satisfy the following criteria:

- It is considered good for Ireland;

- It will create jobs;

- It is in public interest;

- The funds invested have been legally acquired;

- The investor is of good character

Under this programme, the investments which can be made may fall under the following 6 categories:

- An Immigration Investor Bond of €1,000,000 made in Irish Government Bonds at 0% interest;

- An Enterprise Investment of €1,000,000 in the Irish business enterprise must be made for 3 years;

- An Investment Fund of €1,000,000 invested within a government approved fund;

- A Real Estate Investment Trust with a minimum investment of €2,000,000 may be made within any Irish Real Estate Investment Trust listed in the Irish Stock Exchange.

- A Mixed Investment which involves a real estate purchase of minimum value of €450,000 as well as an investment of €500,000 to an Irish government bond. Both minimum investments should amount to €950,000.

- An Endowment of €500,000 made to a non-refundable philanthropic donation which will benefit the arts, sports, health, culture or education.

Once an individual has been granted residency under this programme, he will be able to renew such residency without having to make any further investments. Family members may also be granted residency, without any extra costs involved. This programme also offers the possibility of such individuals obtaining Irish dual citizenship through naturalisation once the requisite period of residency has been satisfied, as is held above.

Start-up Entrepreneur Programme

With the aim of attracting business to Ireland, the Start-up Entrepreneur Programme has been introduced to foreign investments in Ireland. If the competent authority is of the belief that the investment which will be made, with a fund of minimum €70,000, will improve Ireland’s economy, it will grant the applicant a 5-year residency permit, with the purpose of developing the business in question. The start-up venture must satisfy the following conditions:

- It must introduce a new or innovative product or service within the International market;

- It must be capable of creating 10 jobs in Ireland and raising €1,000,000 in sales after 3 or 4 years of starting-up;

- Must be led by an experienced management team;

- Its headquarters are controlled in Ireland, and

- It must be less than 6 years old

Citizenship by Investment Programmes

As can be noted, the ways in which a person may acquire citizenship in Ireland are mainly dependant on family relations or the period of residence within the country. Therefore, persons will have to wait years before they will be able to apply for Irish citizenship.

Recently, several countries have introduced innovative Citizenship by Investment Programmes (CBI) which allow HNWI to acquire their relevant citizenship within a short period of time, and with less onerous obligations which need to be fulfilled.

The programmes currently operating can be divided mainly into two: European programmes and Caribbean Programmes. Under the first category, programmes offered by Malta and Cyprus have shown great success since their inception. They provide applicants with access to the Schengen Area, as well as EU citizenship, which will ultimately allow them to benefit from the four freedoms granted to all EU citizens. The four freedoms allow movement of goods, capital, services and labour, allowing investors to freely move to different Members States for personal or business reasons. These European programmes in particular can prove to be worthwhile alternatives to attaining Irish dual citizenship, considering the facilitated access to the EU which they offer.

Applicants looking for more flexibility in their investment options will be able to make use of the Caribbean Citizenship by Investment Programmes, which are offered by St Kitts and Nevis, Saint Lucia, Antigua and Barbuda, Grenada and Dominica. These programmes offer visa-free travel to approximately 123 – 134 countries at relatively low prices.

The growing popularity of such programmes with HNWI and their families may be attributed to the following enticing characteristics such persons will be entitled to:

- Facilitated travel: One of the main reasons individuals attain a second citizenship, especially under these programmes, is to enjoy the extensive list of visa-free travel these countries provide. The investor and his family would be able to widen their mobility, for personal and business purposes, without the significant amount of restrictions faced in their country of origin. The extent to which visa-free travel is offered depends on which programme is chosen.

- Tax Benefits: To further promote the programmes available, various jurisdictions have introduced tax incentives to the benefit of the investors, aiming at safeguarding and maximising their wealth as much as possible. The fiscal benefits differ from one state to another, however these may include the exemption of taxation on foreign income, wealth, inheritance, gifts or capital gains, as is offered in Antigua, or an attractive remittance-based taxation scheme which is offered in Malta.

- Personal Security: Most HNWI and their families originate from politically or economically unstable countries. By attaining a second citizenship through one of the aforementioned programmes, such individuals will be able to put their minds at rest that their business or personal lives will not be affected by any fall-outs which their country of origin may experience.

- Better quality of life: Besides benefitting from the aforementioned advantages, the HNW family will be able to experience the life they dreamed of in the country of their choice. If the applicant benefits from the Malta Citizenship by Investment Programme or the Cyprus Citizenship by Investment Programme, this will entitle him, and his future generations, to make use of excellent health care systems and educational systems all over Europe.