Malta GDP growth and economic success

According to macroeconomic forecasts published by the European Commission, Malta can expect its economic growth to moderate, yet remain dynamic over the coming years. Current account and budget balances are predicted to remain in surplus according to the latest economic forecast. This corresponds with the fact that the Maltese economy is one of the fastest-growing in the EU, currently claiming record-low unemployment along with solid wage growth.

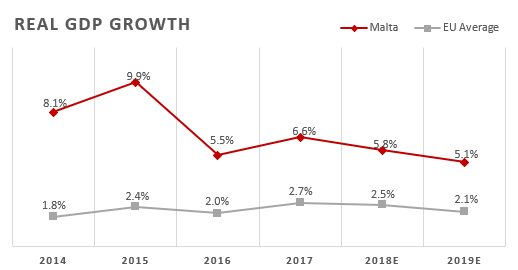

The above average economic growth is expected to be maintained by the Maltese economy even throughout 2019. The Maltese economy has outperformed that of the EU ever since 2014. With animated economic activity in the services sector, exports saw a boost in growth, and as a result not only has this empowered the country’s external position, but it has also brought about a current account surplus and the resulting GDP growth.

Real GDP saw a 6.6% growth in 2017. Along with this, the Maltese economy also saw a substantial increase in the fiscal surplus to 3.9% of GDP for 2017, following a 1% increase in 2016 and government deficits in the previous years. This could be explained with the high growth rate of current revenue, including tax revenue as well as proceeds from Malta’s citizenship programme which had a lively contribution of 2.6% to the country’s GDP. Furthermore, the government debt-to-GDP ratio fell to 50.8% in 2017. With the predicted growth in GDP and the following surplus, the deb-to GDP ratio is expected to diminish further to 43.4% by 2019.

Maltese Economy projected growth

Despite experiencing a minor relaxation in growth rates, compared to 2016 and 2017, the Maltese economy is forecast to continue on its vigorous growth pattern. Real GDP growth is forecast at 5.8% and 5.1% in 2018 and 2019 respectively. The heightened domestic demand is expected to be one of the main drivers of change as a result of an increase in disposable income, expenditure related to national projects and a vibrant growth in the services sectors. Emerging opportunities in up and coming areas such as those of blockchain and cryptocurrency, could also prove to be highly propitious for the Maltese economy.

The strong economic momentum should further boost employment and deduct the already low unemployment rate, which currently stands among the lowest in Europe at 3.5% as of February 2018. The labour supply itself has seen an increase due to inflows in foreign workers and increased participation of women in the labour force. Foreign direct investment reached a total of €165 billion in 2017, leaving its fair impact on both the Maltese economy and employment. So far, the economy has managed to maintain its grip on inflation, which stood at 1.37% in 2017. However, price pressures in the coming years are expected to instigate price increases, resulting in a higher, yet moderate inflation rate of 1.8% in 2019.

Malta Citizenship Programme Contribution to Maltese Economy

Recent statistics on the Malta Citizenship Programme’s performance serve as evidence to the beneficial input the programme has had to the Maltese economy. In the latest report issued by the office of the regulator of the Individual Investor Programme of the Government of Malta, statistics were provided for period between July 2016 and June 2017. In this 12-month period, 377 new applications were submitted. While this shows a decline from the 451 applications recorded during the previous period, it also means that a total of 1101 applications have been submitted since the programme’s inception in 2014.

Since being launched, the Maltese Citizenship Programme has left wide-ranging positive direct and indirect effects on the local economy. In terms of property investments for the period July 2016 -June 2017, the vast majority of applicants (88% or 340) opted for the leased option, whereas the remaining 12% (46) purchased property. The amount invested on property purchases averaged at around €868,173 per property which is notably higher than the minimum €350,000 specified under the programme. Similarly, the annual average rental value for leased property stood at €21,128 compared to the stipulated minimum of €16,000.

During the same period, the amount invested in Government stocks totalled up to €58,371,279. The financial contributions to the National Development and Social Fund amounted to €194 million, while €83 million went into the Consolidated Fund. Concurrently, €16 million in contributions were received by the Identity Malta Agency, which manages the administration of the programme. According to the forecasts published by the European Commission the Malta individual Investor Programme contributed 2.6% of the country’s GDP in 2017.