Malta has experienced an increase in foreign investment, since it launched the Citizenship by Investment programme, according to the programme Regulator (ORiip). The Fourth Annual report on the Maltese Individual Investor Programme (IIP), also known as Malta Citizenship by Investment programme, was issued on the 20th of December 2017. The report provides statistics, including the number of applications received, rejected and those naturalised, for the 12-month period between July 2016 and June 2017. It also offers a comprehensive breakdown by primary citizenship, spouses, dependents and investment options.

Citizenship by Investment applications received

According to the report, 377 applications were submitted during the reporting period, which is around 17% less compare to the 451 applications received during the previous period. This brings the total amount of applications since the programme’s inception up to 1101. Males as main applicants contributed the majority - 79% - of applications received. As regards the employment status, 56.7% of applicants were self-employed, 37.8% declared employed status, and 5.5% were non-economically active.

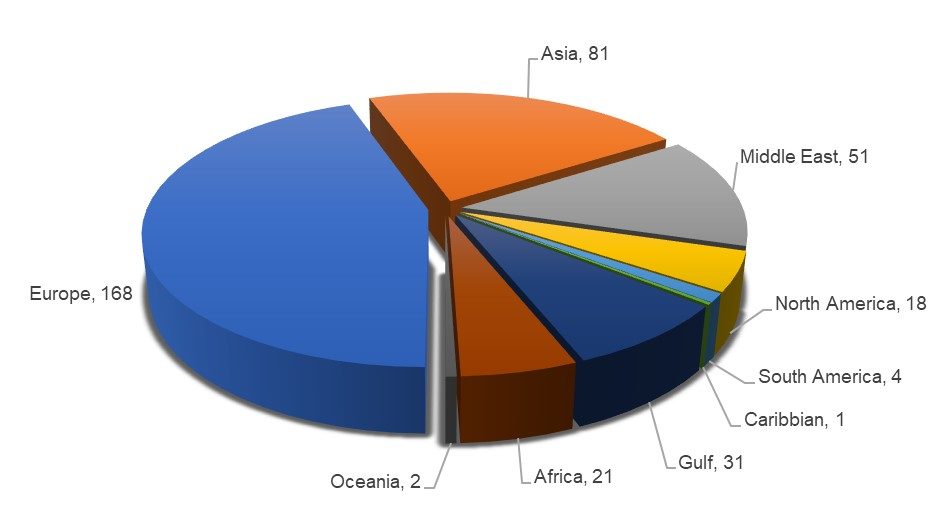

The statistics outline 9 main regions of origin for the applicants (Figure 1), that are Europe (168 applications), the Gulf Region (31 applications), Asia (81 applications), Africa (21 applications), the Middle East (51 applications), North America (18 applications), South America (4 applications), Caribbean (1 application), and Oceania (2 applications). Similar to the previous year, most of the applications came from the European region (mainly Russia and CIS). The number of applications from Asia and the Middle east increased compare to the previous reporting period, while those from the Gulf and Africa decreased. On average, each applicant contributed three dependents in the application, which made 962 dependants in total.

Figure 1. Total IIP applications by Region. Source: ORiip

Outcome of Applications

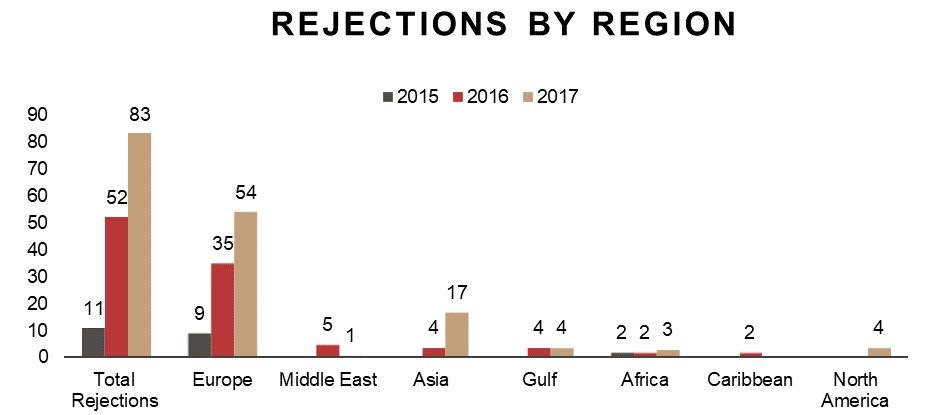

The amount of applications approved, which entails that the due diligence has been positively concluded and a letter of approval in principle has been issued, amounted to 422. This constitutes a significant increase from the previous year, 241, and also from the year before that, 75. This highlights the increased efficiency of the application process. There was also a significant number of applications (83) that were rejected during the year in question (Figure 2). Most of the rejected applications were submitted by applicants from Europe (54) and Asia (17). 386 applications have also reached the naturalisation stage, which is a significant increase from the amount recorded during the previous period, which stood at 137. Overall, the total number of naturalised citizens till the end of June 2017 is 566. Considering the cap of Malta Citizenship by Investment programme of 1,800 naturalisations (excluding dependents), more than 30% of the spots have been filled so far.

Figure 2. Total applications rejected by region. Source: ORiip

Investments and Contributions of the Citizenship by Investment programme

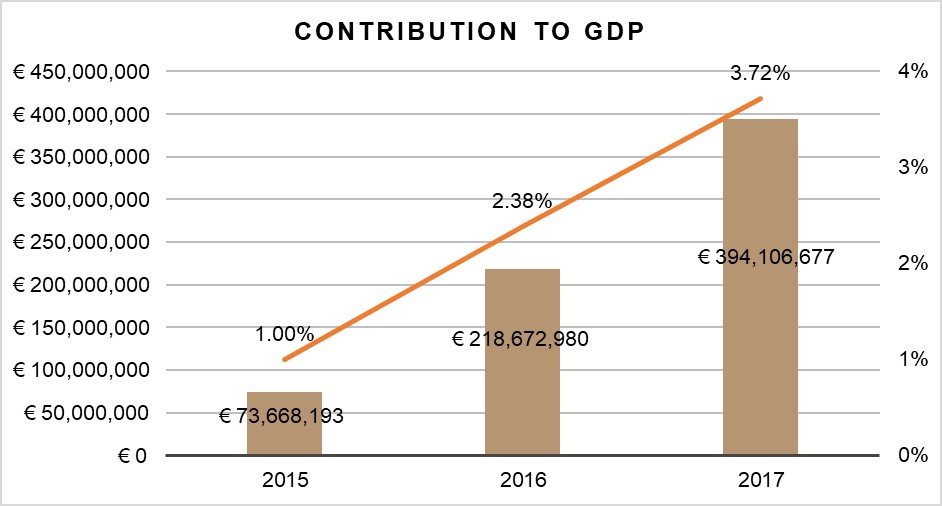

During the reporting period, the financial contributions amounted to €194 million to the National Development and Social Fund; €83 million to the Consolidated Fund; and €30 million to the Identity Malta Agency and the concessionaire. The amount invested in Government stocks between July 2016 and June 2017 totalled €58,371,279.83. Overall, during the reporting period the IIP contributed €394,106,676.68, which is equivalent to 3.72% of the GDP estimated to the same period.

Figure 3. The contribution of the Citizenship by Investment to the GDP. Source: ORiip

In terms of the Real Estate investments from purchased and leased properties, which is mandated by the programme, the contribution amounted to €35,284,168.97 and €33,659,279.80 respectively (considering the 5-years lease contract). The vast majority of applicants – 88% (340) – chose leasing, whereas the remaining 12% (46) purchased a property. Sliema, St. Julians, and Swieqi areas remain the most preferred property locations among the applicants since the programme’s inception. The amount spent by an applicant on a purchased property averaged at around €868,173.58, and the annual average rental value for leased property stood at €21,128.53. Both figures significantly exceed the Malta Citizenship by Investment programme requirements, which is €350,000 for purchasing and 16.000 per annum for leasing a property.