Indian HNWI wealth

There is around US$140 billion in India tied up in venture capital companies and foundations usually owned and run by the HNWIs. However, Indian HNWIs hold a considerable 41% of their financial wealth in foreign countries, with 22.2% of this international wealth allocated to Singapore, 14.4% in Dubai, and 13.4% in London, meaning half of their offshore wealth is held in these three countries alone.

In terms of foreign holdings locations, the Indian HNWI prefers to invest in the Asia-Pacific region with a share of 34.9%, followed by North America 30.9%, and Europe with 12.9%. Economic and political uncertainties are among the main drivers for Indian HWNI offshore holdings.

Indian HNWI are also increasingly looking at diversified wealth management options. Established HNW families are adopting an international perspective to wealth management such as diversification through international real estate investments, whilst younger HNWI are moving away from the traditional family structures and adopting a global perspective to wealth planning.

With regards to real estate, Indian HNWIs view it as a secure investment, and consequently they are looking overseas to invest in popular real estate markets. According to research by property consultancy Cluttons, in 2017, Indian property investments in central London accounted for 22% of all sales. As India has become a more challenging place to invest in, with high loan interest rates and rising prices in the main urban centres, together with increasing global political and economic uncertainty, Indian buyers with a larger amount of capital to spend have increasingly turned to London and other foreign jurisdictions as an investment destination of choice.

Indian HNWI migration

India’s economic growth has fuelled an impressive demand for travel in India, with the number of passenger trips doubling over the last four years to 200million. Most luxury purchases are also usually made abroad, thus creating more demand for luxury travel. On the other hand, there is also a substantial amount of Indian HNWIs that are leaving the country for good. In 2017 it was reported that between 6,000 and 7,000 HNWI left India, following 6,000 in 2016, and 4,000 in 2015. Indian citizens are restricted to 56 visa-free access destinations, a factor which substantially contributes to their demand in residency or citizenship by investment programmes as they would greatly increase their international mobility by providing, for instance, visa-free travel within the Schengen area. Their outward investment and residency outlook is also rooted in tax planning purposes, greater economic freedom which can be found in foreign jurisdictions, domestic safety and security concerns, greater ease in doing business, a better quality of life, and fewer environmental risks.

With regards to preferences for migration locations, the recent trends for Indian HNWI have centred around the USA, UAE, Canada, Australia and New Zealand. Their demand for residency programmes is substantiated in recent statistics- Spain granted 626 residence permits to Indians from the period of 2013-2016. Meanwhile, the EB 5 Immigrant Investor visa received 580 applications from Indians from April 2017 to March 2018- a 222% increase from the 2016-2017 period.

Surge in Indian HNWI wealth and population

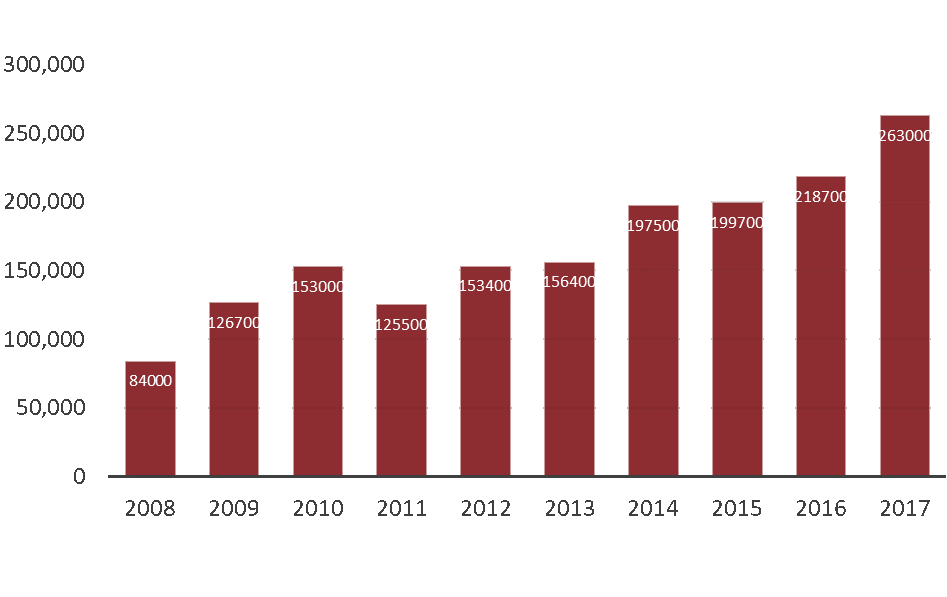

This trend of HNW migration would not be possible without the increase in the population of Indian HNWIs and the wealth they hold. India is fast becoming a leader in the generation of wealth. It is expected that India will account for 13% of the world’s HNW population by 2025. According to the 2018 Capgemini World Wealth Report, India was the fastest growing HNWI market in 2017, seeing a 20.4% increase in its HNWI population, and 21.4% increase in its HNWI wealth. The graph below demonstrates this gradual progression of Indian HNWIs, with latest figures showing that the Indian HNWI population stood at around 263,000 in 2017.

Data source: Capgemini World Wealth Reports