Many high net worth individuals have chosen Malta and Cyprus as their second home, following the launch of the Malta and Cyprus Citizenship by Investment programmes. The Cyprus Citizenship by Investment programme was launched in 2013, just one year earlier than Malta Citizenship by investment programme, or the Individual Investor Programme. One of the programmes’ requirement in both countries is an investment in real estate.

Investing in real estate

To acquire Maltese citizenship, a candidate must purchase a property worth at least €350,000 and keep the property for at least five years. Alternatively, an applicant can lease a property for five years, with a minimum lease value of €16,000 a year. Under the Cyprus Citizenship by Investment programme, the candidate has two different options to obtain citizenship – a combination of real estate and/or other investments with a minimum value of €2.5 million; or a €2 million (plus VAT) investment in residential real estate. Regardless of the route chosen, a residential real estate of a minimum value of €500,000 must be held indefinitely, while the rest investment can be recovered after 3 years.

Impact of Citizenship by Investment programmes on real estate

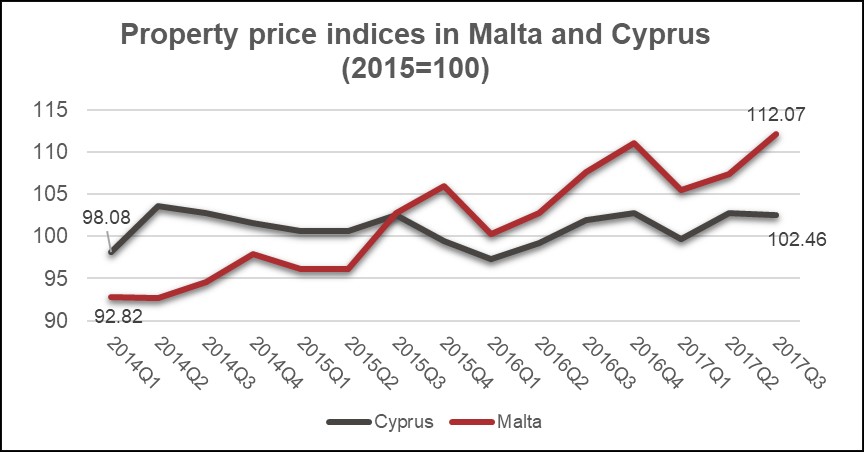

According to the Central Bank of Malta, the Malta Citizenship by Investment programme is one of the major contributors to the positive trend in the property market. Malta’s real estate and construction industry has witnessed significant growth in the past four years, contributing on average 9% to the country’s Gross Value Added (GVA), according to the National Statistics Office. Between Q1 2014 and Q3 2017, there was an increase of over 19% in Malta’s property prices (Figure 1). The Cypriot real estate market also experienced an increase in prices albeit at a much lower rate of 4% over the same period.

Source: Eurostat, CCA analysis

One of the main reasons fuelling property prices in Malta, is the impact that the Malta Citizenship by Investment had on the rental market, given the possibility of renting a property instead of buying it. In fact, the latest report from the Office of the Regulator of the Individual Investor Programme, revealed that since the programme’s inception till 30 June 2017 over 85% of applicants chose the leasing option.

The rise in property prices can also be attributed to other factors, such as a significant economic growth, increase in foreign workers which contributed to the increased demand for rental property, and increased demand for office space. According to the Central Bank of Malta, rental prices for a 1-bedroom flat in high demand areas (Sliema, St. Julian’s, Gzira and Valletta) increased over 40% between 2012 and 2015, while the increase in rents of detached houses in the same region amounts to almost 80%. For other regions, the rental prices of flats and detached houses also increased significantly by more than 30% over the same period.

The positive trend in the rental market, has also triggered a rise in the prices for acquisition of property, creating a favourable environment for property investment. In this regard Malta’s rental yield reached 6.64% in 2017, according to the Buy-To-Let table of the new WorldFirst’s research. Malta was ranked the 2nd most attractive country in Europe for buy-to-rent investment in 2017, which took a steep boost from the 8th place in 2016. Being ranked 9th in the table, Cyprus has a rental yield of 5.7%. Despite a more moderate rental yield, the real estate market in Cyprus remains a very attractive preposition for investment, especially due to increased demand as a result of the Cyprus Citizenship by Investment programme as well as a result of the stability of the market.